Innovative Partnerships Group’s team of consultants, data analysts, and marketing scientists have been on the cutting edge of partnership valuation for brands and monitors the trends in the sponsorship industry. We have performed dozens of naming rights and sponsorship valuations, and over the past 12-18 months have had many clients, industry leaders and decision makers note there was a massive void in the market on data and trends related to credit unions and sponsorship.

This inaugural “Sponsorship and Naming Rights Survey” is the first time that a company has taken an in-depth look at sponsorship, naming rights trends and best practices to help credit unions maximize their sponsorship investments and understand critical best practices when negotiating and executing partnerships. The results provide benchmarking research and actionable insights to decision makers who support and influence future partnership marketing activities.

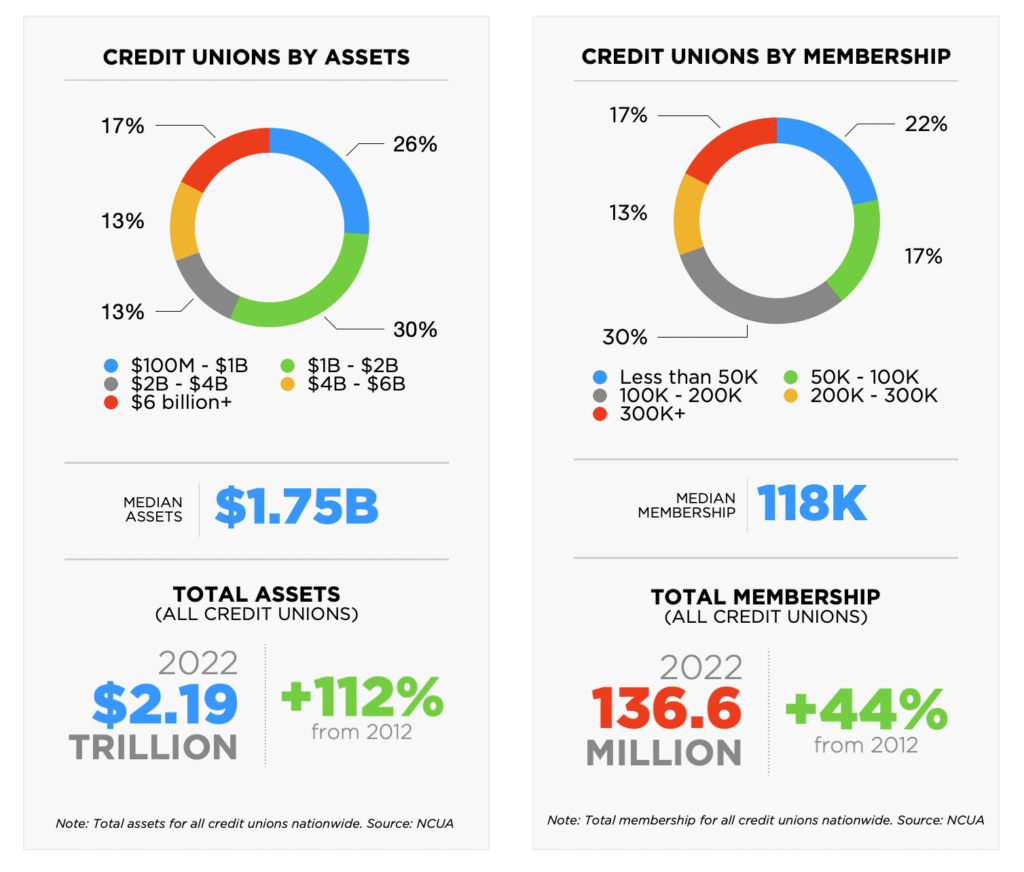

More than 135 million people are now members of credit unions in the United States, up 44% from a decade ago. More telling, however, is credit union assets have more than doubled during that same period to $2.19 trillion. Overall credit union marketing budgets have exceeded asset growth levels, but are still relatively low compared with major financial service companies. And yet credit unions are one of the fastest growing sponsorship and naming rights categories in the industry for sports teams and universities due to expanding partnership efforts.

Committing significant portions of marketing budgets to sponsorships is new for some organizations. All survey participants reported that sponsorships have been added to their marketing programs within the past 20 years. As budgets have increased, credit unions have sought non-traditional forms of media to reach out-of-home audiences while complementing existing social/digital marketing channels. As credit unions become larger and more comprehensive financial institutions, their mass appeal has opened new avenues for marketing and partnerships.

PARTICIPANTS

This survey was conducted from April to July, 2023. Twenty-three (23) credit unions provided in-depth responses about their sponsorships and naming rights partnerships, representing a diverse group of credit unions both geographically (across 15 states in all regions of the country) and economically. Many credit unions, including some in the survey, have been expanding fields of membership and altering charters to drive growth. Notably, six of the credit unions surveyed made a change to their fields of membership within the past year.

KEY FINDINGS

The results of the inaugural study uncovered a demand for sponsorships and naming rights by credit unions. Participants look for metrics and qualitative/quantitative results to help them maximize their significant investments in sponsorship and naming rights as a percentage of their media/marketing mix. Measurement is a challenge to credit unions who typically look at traditional media channels like digital, social, OOH, radio and TV/broadcast for data.

MARKETING

Overall, typical budgets ranged up to $20 million annually. Traditional paid media accounts for less than 50% of marketing expenditures for the vast majority of those surveyed. The majority of credit unions allocate 26-50% of marketing budgets to sponsorships and an even higher percentage consider sponsorships to be a “very” important part of the overall marketing mix. This is because sponsorships offer a mix of traditional paid media advertising along with affinity marketing.

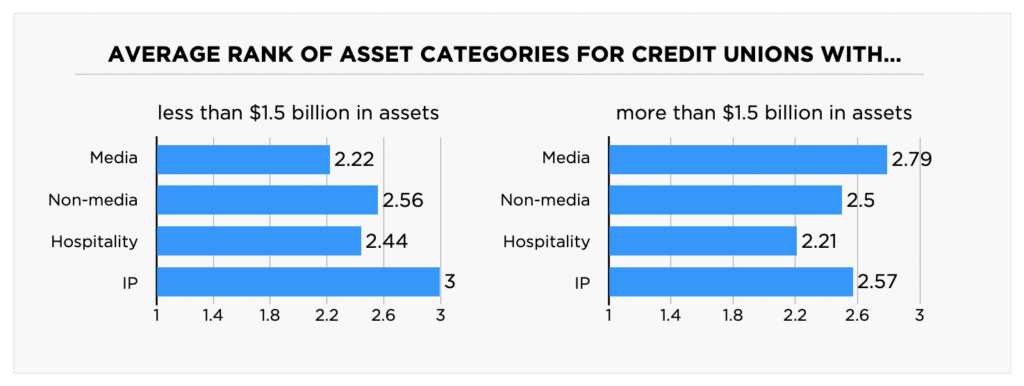

When asked about views on sponsorship asset categories, media assets were ranked highest among respondents with assets greater than $1.5 billion. Intellectual property was the most polarizing category. It was ranked highest and lowest by four credit unions each among the 14 credit unions with $1.5 billion in assets or more. That reflects the importance of tailoring partnerships to satisfy individual marketing objectives.

In contrast, small credit unions (those with less than $1.5 billion in assets) ranked intellectual property rights as the most important and media assets as least important.

Among individual asset categories, exclusivity ranked highest despite two credit unions giving it the lowest score possible. It was nearly universally recognized as the most effective element to drive return on sponsorship dollars. Other powerful assets were social media, promotions, on-site activations and public relations.

SPONSORSHIP

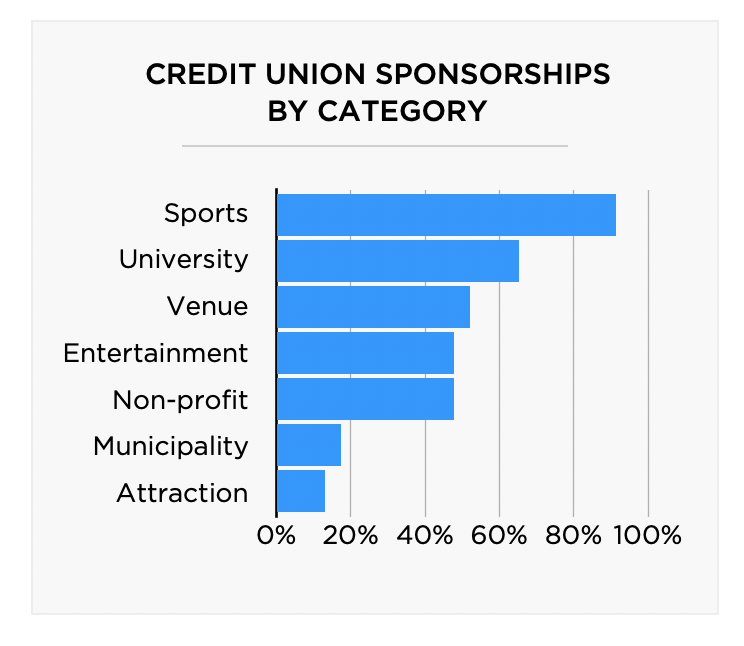

Sports is the dominant category among the types of credit union sponsorships, followed by universities, non-profits and venues. philanthropic efforts and community events.

For sports, collegiate teams are the most frequent partners for credit unions. While athletics represent one of the highest affinity groups with broad appeal, there were significant numbers of deals with student bodies and alumni associations. Alumni associations may be a potential group for credit unions to target within a university as these organizations can offer memberships that align with credit union demographics and offer penetration outside its hometown market.

MEMBERS & EMPLOYEES

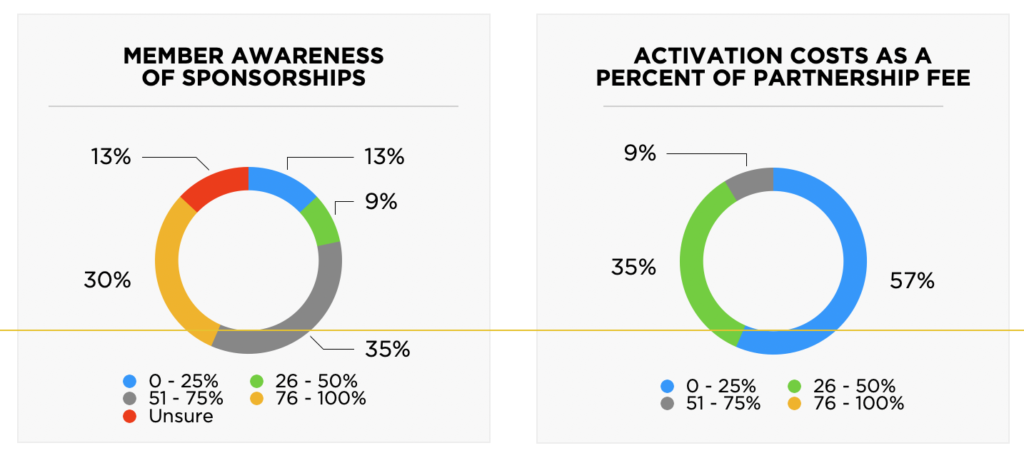

We asked credit unions to assess their members’ and employees’ awareness of their sponsorships. Credit union members need a high level of engagement with their institutions given their local community ties and niche membership groups. Large national banks and other financial institutions may have a more difficult time establishing an authentic connection with consumers.

The results show that credit unions have a lower awareness than what is deemed to be reasonably acceptable in sponsorship measurement. There is an opportunity to strengthen sponsorship activation and measurement programs to more adequately measure the unaided brand awareness of sponsorship which is one of the most critical elements of sponsorship.

Another key stakeholder group is the credit union employees. The majority of those surveyed indicated that employees are aware of partnerships, although the numbers decline slightly when asked if employees are positively impacted. Many of the sponsorship deals are focused and aligned with marketing goals and employee benefits are a secondary consideration. About half of those surveyed leverage partnerships through volunteerism, tickets, etc. This may be an underutilized area of partnership activation, which has been traditionally focused on brand awareness.

Activations are an additional cost for partnerships that must be considered to maximize value. Most credit unions dedicated 50% or less of a sponsorship fee to activation.

NAMING RIGHTS

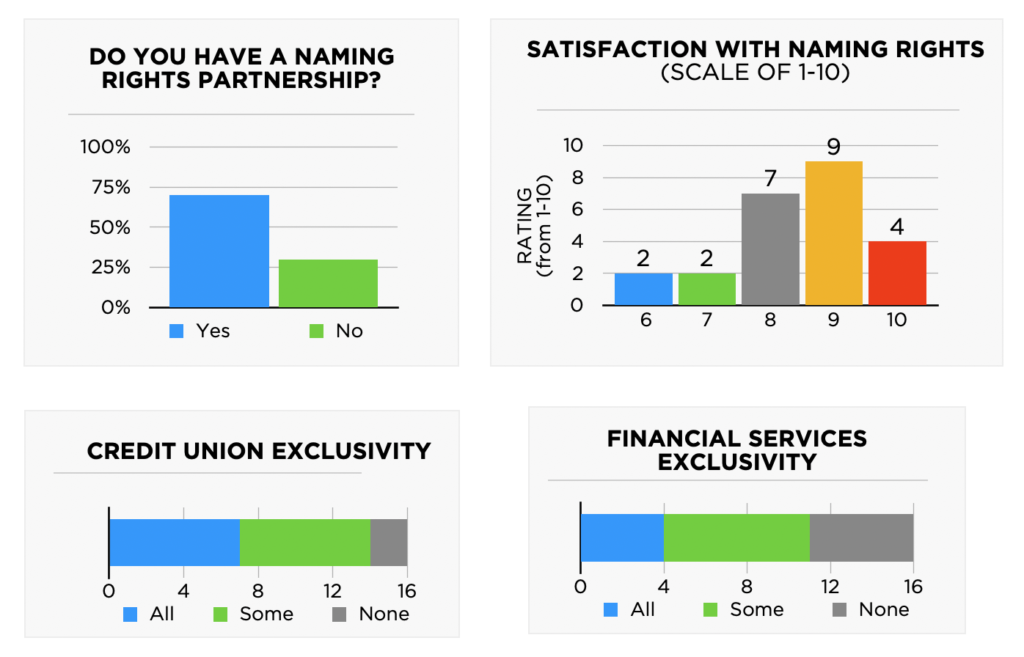

About two-thirds of those surveyed have at least one naming rights partnership. Credit union services are included in rights deals, but credit unions frequently offer more robust financial services. Exclusivity, which is usually a key component of deals for larger categories such as automotive and beverage, is important for credit unions - but only half of those who have naming rights partnerships include category exclusivity in the “credit unions” category for all deals while others include it in some of the time. The numbers decline for the broader banking category and financial services category designations.

BEST PRACTICES

Looking forward, credit union marketing executives are constantly looking for new ways to engage consumers. Media is a fragmented industry, but it’s possible to leverage different media channels combined with on-site activations and digital/mobile banking offerings to provide robust partnership opportunities. In addition, rights holders in emerging markets or with access to unique demographics that align with credit unions should seek ways to partner. Lastly, although the responsibility to measure a partnership could fall on both parties, credit unions desire better metrics that can be delivered more frequently to measure effectiveness.

To register for the 2024 Credit Union Sponsorship Survey, or to request a copy of the full Executive Summary, please email Jeff Dimond at jdimond@ipg360.com.

*Innovative Partnerships Group served as the third-party administrator of the survey and held participants’ data in the strictest confidence. The questions in this survey were reviewed by a Steering Committee made up of executives from a select group of credit unions in order to ensure accuracy, relevance, and ability to make an impact for those participating.

Municipalities

City of Charlotte

The City of Charlotte is looking to undertake a number of large, city-defining initiatives, including an Innovation Park and a mixed-use District within the downtown core of the city. Bringing the right partners to the development is key in the District’s long-term success. Innovative Partnerships Group conducted an analysis on the commercial viability of assets within the city, specifically within the mixed-use Sports and Entertainment District around the Hornets’ new training center.

Bison World (Jamestown, North Dakota)

Innovative Partnerships Group was engaged by the Jamestown/Stutsman Development Corporation to create a viable commercial sales strategy and roadmap for Bison World, a planned “destination attraction” and the first theme park centered around Bison, America’s national mammal. Located in Jamestown, ND (“Buffalo City”), Bison World is scheduled to open in 2026 and the theme park is expected to become a tourism gateway for the state with a variety of high value assets for new Naming Rights and Founding Partners.

Sports Clients

Portland Timbers Front of Jersey Sponsorship

Innovative Partnerships Group was retained by The Portland Timbers for their most coveted asset – the Front of Jersey sponsorship – for the first time since its inception. Innovative Partnerships Group also worked with the Timbers in 2017 to renew its existing jersey partner and have been actively leveraging its creative studio over the last few months to re-skin custom videos to highlight how new brands can fully integrate with the team. The Timbers have historically been one of the most successful teams in MLS and are pushing for a playoff spot this year. With Lionel Messi providing unprecedented excitement and attention, and MLS’s increased distribution through AppleTV, the Timber’s platform has never been more valuable.

ocV!BE/Anaheim Ducks Development

The Anaheim Ducks will be part of a new, groundbreaking sports and entertainment district that will redefine 100 acres of Anaheim to become the epicenter of Southern California lifestyle activity. Innovative Partnerships Group has been selected to generate long-term commercial revenue for ocV!BE and its numerous planned music venues, parks, dining, hotels and office spaces. The 2028 Olympic Games will host volleyball events at ocV!be, and we are thrilled to be part of this influential project in our own backyard!

The Valuation & Consulting team’s Data Insights & Reporting division just completed its first survey focused on naming rights and sponsorship for the credit union industry. The genesis of this particular survey resulted from our work with several credit unions where we found that, despite the hundreds of credit union sponsorship deals, there is very little accurate information on trends and best practices in this sector. We worked closely on the questionnaire with a Steering Committee made up of executives from a select group of credit unions to ensure accuracy, relevance, and ability to make an impact. It is the first time that a company has taken an in-depth look at sponsorship and naming rights to help credit unions maximize their sponsorship investments and understand critical best practices when negotiating and executing partnerships.

Twenty-three (23) credit unions of various asset and member size completed the survey. The results provide meaningful benchmarking results, research and actionable insights to decision makers who support and influence future partnership marketing activities that had not been typically captured for this important industry sub-sector. It is clear that the rise in sponsorships and naming rights for credit unions is one of the fasting growing sponsorship categories in the U.S. It is even more evident that participants are continuing to look for metrics and qualitative/quantitative results to help them maximize their significant investments in sponsorship and naming rights as a percentage of their media/marketing mix.

Measurement continues to challenge credit unions who typically look at traditional media channels like digital, social, OOH, radio and TV/broadcast for data. More than 50 percent of credit unions indicated that they do not engage a study measuring the impact of their partnerships on members or plan to do so within the next 12 months. For the first time, credit unions now have a mechanism to value sponsorship similarly to these other media mix options by creating a custom model that quantifies how the different media/non-media assets drive revenue/profit.

Innovative Partnerships Group recently created a subdivision within its Valuations & Consulting team called Data Insights & Reporting. This new group will enhance the value proposition to both brands and properties by providing access to proprietary information that is both customizable for the brand while designed for public dissemination. Our goal is to help the naming rights and sponsorship industry with cutting edge research, tips and insights on long-term business partnerships that can spark thought leadership.

Our initial strategy is to focus on analysis, trends and best practices in sponsorship within specific industry sectors. After completing an initial survey of credit unions, our team will explore new surveys through the following verticals in the upcoming months – Healthcare, EV, Energy and/or FinTech – with the goal to create new marketing vehicles (e.g., blogs, podcasts, client profiles etc.) that showcase Innovative Partnerships Group’s best-in-class services and range of expertise.

Innovative Partnerships Group has been luxury electric car manufacturer VinFast’s Agency of Record, creating and supporting their Sponsorship Valuation & Strategy, since the beginning of 2022. In preparation for their U.S. launch, we worked alongside Vingroup to host exclusive, elite tours of Vietnam. These VIP trips included memorable experiences of Vietnam’s culture, private tours of the state-of-the-art EV plant, and test drive opportunities.

VinFast began its first foray into building partnerships in the U.S. last year when it announced that it would become the first-ever naming rights partner of the IRONMAN U.S. Series starting in 2022. Along with the naming rights, VinFast also became the title partner for the IRONMAN World Championship and the IRONMAN 70.3 World Championship. Innovative Partnerships Group has worked with VinFast behind the scenes to bring these two companies together.

VinFast has taken its next steps into the U.S. market with the groundbreaking of its first electric vehicle manufacturing facility spanning 1,800 acres in Chatham County, NC. The company chose this location after the state offered a $1.2B incentive package with the hope that the investment would create 7,500 new jobs. VinFast aims to produce 150,000 vehicles per year at the plant.

Going Public

In August VinFast made another big step in its growth into the U.S. market when it made its debut on NASDAQ. The company opened its shares at $22, but those numbers rose sharply, and at the end of the day, they closed at $37.06. VinFast CEO Madame Thủy spoke to CNBC on the company’s decision to go public: “It’s a big milestone for us to be listed in the U.S. The listing is going to open access to the capital markets for us in the future.”

As VinFast continues to grow, Innovative Partnerships Group is working closely with Madame Thuy in supporting fleet sale opportunities across the U.S. The goal for the remainder of 2023 into Q1 2024 will be to continue the positive brand recognition and grow the consumer and corporate electric vehicle sales verticals.

Times Square, one of the most iconic sites in the world, has never seen anything like TSX. A first-of-its-kind entertainment venue located in the heart of the Big Apple. TSX is creating one of the most ambitious mixed-use developments in all of New York City. In a multi-year relationship, Innovative Partnerships Group was selected as TSX’s exclusive agency of record for sponsorships and naming rights and has created a unique platform to build out some of the largest global partnerships in the entertainment industry.

TSX launched its permanent main stage on July 18, 2023 with one of the largest events ever held in Times Square. The surprise concert by superstar Post Malone was the highest attended live performance in decades. Post Malone said during the show, “This is the coolest venue in the f–king universe.” His social media followers clearly agreed, as his TSX post garnered a whopping 600,000+ likes on Instagram while the video of his performance generating billions of impressions. For more information on this epic moment, see the article on Billboard.

Anchored by the Hilton Hotel’s new flagship brand, Tempo by Hilton, which opened in August, TSX is becoming the epicenter of entertainment, staging the world's biggest pop culture moments and serving as a new and innovative way for artists and brands to reach fans around the world.

Global buzz has already begun with these pop culture-defining moments in 2023:

Innovative Partnerships Group is excited to be working with TSX to re-define the entertainment industry.

On this episode of The PlayBook Podcast, Host David Meltzer sits down with two brilliant business minds - Len Komoroski, CEO of the Cleveland Cavaliers, and Jeff Marks, CEO of Innovative Partnerships Group. They chat about the keys to building successful partnerships and give listeners insight on how to create revenue through the emotional aspects of sports.

Listen Here: The Key to Building Successful Partners

Marks and Komoroski also look forward at the future landscape of sports partnerships. They discuss how, as sports business and technology evolve, properties can adjust their approach to building sponsorships and, in turn, better create sustainable revenue streams. They then provide predictions for changes sports marketers can expect in the coming yea

This article was originally published in Charlotte Business Journal

Written by Erik Spanberg

City consultant Innovative Partnerships Group explained how corporate naming rights have expanded to sports- and entertainment-themed districts and how that could generate $60 million from a Brevard Street development.

Charlotte City Council’s economic development committee spent nearly three hours yesterday sifting through details of a $275 million proposal to renovate Spectrum Center and build a separate practice center for the NBA Charlotte Hornets.

The committee meeting was more of a full council meeting. Mayor Vi Lyles attended and, between the Government Center meeting room and virtual attendees, all but two of the 11 council members were present. Renee Johnson and Matt Newton were absent.

Tracy Dodson, an assistant city manager and head of the city’s economic development division, walked the mayor and council members through the following aspects of the proposal introduced last week:

“I felt like it was a really good conversation,” Dodson said afterwards. “I felt like we started to chip away at some of the questions that council members addressed last week and brought up. I’m hopeful that we can continue to do this while also bringing in public comment to get us to a vote next week.

”A majority of council members must vote in favor of the proposal for it to take effect. The vote is scheduled as part of council’s regular meeting June 13.

The Hornets’ current lease at the city-owned Spectrum Center ends in 2030. As part of that agreement, city government is obligated to make periodic renovations to the building that keep the venue on par with features included in at least 50% of NBA arenas. In addition, the city must keep basic components — ventilation, seating, elevators, and so on — up to date and in good working order.

Spectrum Center opened in 2005. It cost $265 million to build, or $392 million when adjusted for inflation. The construction debt will be fully retired in 2033. If the city approves the arena renovations and the new practice center, the Hornets will extend their lease at Spectrum Center through 2045, pay $32 million in rent to the city through the end of the revised agreement, and absorb any construction overruns.

Council members spent the most time yesterday asking questions about sponsorships to fund the practice center as well as the basis for redeveloping the transportation center.

Jeff Marks, CEO at Innovative Partnerships Group, made a virtual presentation as part of yesterday’s meeting, explaining how corporate naming rights have expanded from arenas and stadiums to sports- and entertainment-themed districts. Innovative Partnerships Group, as a consultant to the city, estimated naming rights sponsorships for a fledgling district near the arena along Brevard Street could, along with related agreements, generate $60 million.

Marks’ math works like this:

The consultant said variables in structuring the agreements could slightly shift the mix of rights and revenue. But, he said, the growth of Charlotte and increasing interest among companies to reach that population will sustain the projections outlined above. Dan Barrett of consulting firm CAA Icon, which represented the Hornets in the arena negotiations, was at the Government Center yesterday. Barrett told council it’s likely existing sponsors of the Hornets and arena will be interested in new sponsorship opportunities around the building.

Dodson and Marks assured council members the city would maintain control over the scope of sponsorship rights as well as which companies the city will, or will not, work with. Marks noted companies have embraced the broader range of programs and platforms, including environmental causes and product tie-ins, that a district can offer, as opposed to a stand-alone sports venue.

Ed Driggs, the committee’s vice chair, asked about the arena naming rights with Charter Communications Inc.’s (NASDAQ: CHTR) Spectrum. Dodson responded that those rights are controlled by the Hornets. She added the city intentionally steered clear of seeking any sponsorship revenue inside the arena.

The Hornets manage Spectrum Center as part of their lease with the city. That arrangement means the NBA franchise pays all operating expenses and receives all operating profits — and absorbs any losses.

Driggs and other council members asked in several ways and several times whether they would have a chance to parse the language and terms of prospective sponsorships and were told they would. Without the sponsor revenue, the city would have to find alternative funding, Dodson said.

Questions surfaced about the viability and likelihood of success for redeveloping the transportation center, the spot targeted for the Hornets’ training center.

Charlotte Area Transit System controls the 2.6-acre publicly owned property that has been home to the bus center since 1995. It is bounded by the light-rail line and East Fourth, South Brevard, and East Trade streets.

In 2019, the city granted development rights for the property to Charlotte-based White Point Partners and Dallas real estate investment firm Dart Interests. White Point and Dart secured those rights after a competitive bidding process. The catch, as Dodson reiterated several times yesterday: The site must remain a transit hub first and foremost.

Transit chief John Lewis told the committee the transportation center is antiquated and would need to be replaced with or without the companion private development and investment by White Point/Dart. Private investment, the Hornets’ practice center, and a subterranean bus station form the nexus of transit needs and economic development aspirations, he said.

The developers’ pitch was considerably strengthened because they own vacant land across the street that can be used as a temporary transit hub while the existing transportation center is rebuilt, Lewis added. Minimizing disruptions and inconvenience for riders is a big part of CATS’ considerations, city and transit leaders said.

“The CTC is a transit project first,” Dodson said.

Some on council remain skeptical of the NBA arena’s ability to foster an entertainment district and nearby private investment. Council member Braxton Winston told the committee that little to no development has occurred in the area since the arena opened in 2005. “It pretty much looks the same,” he said.

Much of the property around Spectrum Center is controlled by local or state government, meaning the lack of activity is attributable to government, not the private sector, councilman Larken Egleston said.

In addition, the EpiCentre, a nearby, privately held entertainment complex that is going to be auctioned next month, could shift interest and momentum in the area, too.

Council member Tariq Bokhari, a frequent critic of the transit agency, expressed doubt and reservations about CATS’ ability to spur redevelopment. Bokhari asked Dodson for more detail about the city’s fallback plan — building the practice center on a city-owned gravel lot behind the arena — before the vote.

Barrett, the team consultant, and the city’s arena consultants, David Abrams (Inner Circle Sports) and Steve Patterson (Pro Sports Consultants), all emphasized the need to upgrade the arena to keep pace with neighboring cities and buildings competing for the same concerts and other events that generate revenue and visitor spending. Abrams and Patterson, like Barrett, came to Charlotte to appear before council yesterday.

To cite one nearby example, Raleigh’s NHL arena is being pitched for up to $200 million in upgrades.

Malcolm Graham, the committee chair, and committee member Dimple Ajmera pronounced themselves satisfied with pledges from Charlotte Regional Visitors Authority CEO Tom Murray to bid aggressively for the CIAA Tournament when it is next available. The soonest it could return is 2026.Other concerns raised yesterday included possible impact on anticipated requests such as a major makeover of the city-owned Discovery Place Science museum on North Tryon Streetand long-term funding for arts and culture organizations.

Dodson pointed out that, in the case of Discovery Place, the museum controls adjacent property that could be sold or converted into a commercial project to generate additional revenue to help pay for renovation costs. Council member Julie Eiselt, a lead player in the city’s public-private campaign to increase grants for museums and theaters, told Dodson and others that she has yet to receive data from the city comparing the economic benefits of arts and sports.

03.24.2022

Innovative Partnerships Group has help secure another transformational naming rights partnership between Cal State University Northridge (CSUN) and Premier America Credit Union. This first ever naming rights deal to the arena now called Premier America Credit Union Arena. The partnership also includes Premier America being designated as the “Official Credit Union of CSUN,” the “exclusive” credit union partner of CSUN Athletics and the CSUN Alumni Association. Marci Francisco, Senior Vice President, Chief Experience Officer, stated our deep appreciation to Innovative Partnerships Group’s excellent work on this initiative. Your team was key in expanding the relationship, negotiating great terms, making fantastic suggestions and ensuring that we have a partnership that will be mutually beneficial for both organizations. I cannot speak highly enough of Innovative Partnerships Group and Sean Moran who led the negotiations.

NORTHRIDGE, Calif. – California State University, Northridge officials today announced a 10-year, multifaceted partnership agreement with Premier America Credit Union. The long-term commitment supports events and programs that benefit students and alumni and includes the renaming of the university’s athletics facility after the company.

In addition to renaming the Matadome — home to CSUN’s men’s and women’s basketball and volleyball teams — to the Premier America Credit Union Arena. The partnership also includes Premier America being designated the “Official Credit Union of CSUN,” the “exclusive” credit union partner of CSUN Athletics and the CSUN Alumni Association, and the official affinity credit card provider for the alumni association.

“Premier America’s emphasis on people working together toward solutions and vested interest in collective success aligns well with CSUN’s approach toward the academic success of our students and their collective impact on our region, state and nation upon graduation,” said CSUN President Erika D. Beck. “I am delighted that we will be working together to further the success of our students and, in particular, our student-athletes.”

The agreement between CSUN and Premier America was approved by the CSU Board of Trustees at their meeting today.

“Our organizations are a perfect match, and we’re honored to partner with CSUN,” said Premier America President and CEO Rudy Pereira. “CSUN’s deep commitment to building a brighter and more equitable future for its students, their families and the community is aligned with our core values. We look forward to working together as we promote financial well-being and provide opportunity and guidance to our richly diverse community.”

Founded in 1957, Premier America is one of the nation’s largest credit unions, with more than 100,000 members and more than $3.4 billion in assets. Premier America’s relationship with CSUN was secured in concert with multiple parties, including LEARFIELD (CSUN Athletics’ multimedia rightsholder), ADC Partners and Innovative Partnerships Group. LEARFIELD’s local Matador Sports Properties works closely with the athletics administration.

“There are so many positive things that occur when partnerships include naming rights and extend beyond athletics to the greater campus community,” said LEARFIELD Senior Vice President Megan Eisenhard. “This brand-new relationship will provide impactful benefits to CSUN constituents and Premier America Credit Union members now and for many years to come. We’re proud to help bring these two history-rich organizations together.”

“Rarely do you see two organizations that are so aligned in their mission,” said David Almy, principal of ADC Partners. “Honestly, it’s humbling to be able to play a role in helping craft such a wide-ranging partnership that has the potential to do so much for both groups.”

The partnership between Premier America and CSUN includes the opening of a campus credit union branch and the installation of ATM machines, hosting of financial wellness and literacy programming, and the sponsorship of various student and campus events. Premier America also will sponsor events at CSUN’s Younes and Soraya Nazarian Center for the Performing Arts (The Soraya), as well as other events in coordination with the CSUN Alumni Association.

In addition to the renaming of the athletics facility, Premier America Credit Union’s name will be displayed prominently on the court, and the credit union will sponsor games during basketball, volleyball and baseball seasons.

“CSUN is thrilled for this partnership with Premier America Credit Union,” said CSUN Director of Athletics Mike Izzi. “CSUN Athletics continues to raise the bar in all areas; on the field of play, in the classroom and in our business relationships — and this new partnership with Premier America Credit Union is another giant step forward for the Matadors. We’re proud to work with our campus partners and friends at Premier America to create a meaningful brand partnership that will benefit us all. Our main objective is supporting the welfare and achievement of our student-athletes, and this partnership will provide better opportunities for continued success in the years to come.”

About Premier America Credit Union:

Premier America is a full-service community financial institution that offers exceptional banking to more than 100,000 Member-Owners. Member-Owners benefit from personal service, great savings rates, low fees, low loan rates and a full complement of savings, lending, wealth management, and insurance services. Founded in 1957, Premier America is one of the nation’s largest credit unions, with more than $3.4 billion in assets. With 20 retail branches, access to over 30,000+ surcharge-free ATMs through the CO-OP ATM Network; and the CU Service Center Shared Branch Network, Premier America provides financial services to those who live, work, worship or attend school in the Ventura and Los Angeles counties of California, and Harris County in Texas. To learn more about Premier America, please visit www.PremierAmerica.com.

About California State University, Northridge:

One of the largest universities in the country, California State University, Northridge (CSUN) is an urban, comprehensive university that delivers award-winning undergraduate and graduate programs to more than 38,000 students annually and counts nearly 390,000 alumni who fuel the region’s economy. Since its founding in 1958, CSUN has made a significant and long-term economic impact on California, generating nearly $1.9 billion in economic impact and nearly 12,000 jobs each year. The university’s learning environment is the third-most diverse in the nation, according to The Wall Street Journal/Times Himes Higher Education College Ranking. CSUN ranks among the top 10 universities in the country for social mobility.

Sports Business Journal presents the nominees for the 15th annual Sports Business Awards, recognizing excellence over the past year. The winners will be determined by a group of more than 40 industry executives. Award recipients will be announced during our live event on Wednesday, May 18, at the New York Marriott Marquis Times Square.

Sports Business Journal has nominated Innovative Partnerships Group for agency of the year in the category: Best in Property Consulting, Sales and Client Services. This is the second nomination for Innovative Partnerships Group who was also nominated in 2020 prior to Covid.

Innovative Partnerships Group had another record-breaking year of business development and consulting for some of the industry’s most meaningful partnerships leveraging its proprietary Partnership Intelligence methodology.

For the full list of nominees, visit the Sports Business Journal.

In addition, Kraft Group Founder, Chair & CEO ROBERT KRAFT will be presented with our Lifetime Achievement Award as well that night.

For more information, please visit Innovative Partnerships Group at ipg360.com or info@ipg360.com