Innovative Partnerships Group’s team of consultants, data analysts, and marketing scientists have been on the cutting edge of partnership valuation for brands and monitors the trends in the sponsorship industry. We have performed dozens of naming rights and sponsorship valuations, and over the past 12-18 months have had many clients, industry leaders and decision makers note there was a massive void in the market on data and trends related to credit unions and sponsorship.

This inaugural “Sponsorship and Naming Rights Survey” is the first time that a company has taken an in-depth look at sponsorship, naming rights trends and best practices to help credit unions maximize their sponsorship investments and understand critical best practices when negotiating and executing partnerships. The results provide benchmarking research and actionable insights to decision makers who support and influence future partnership marketing activities.

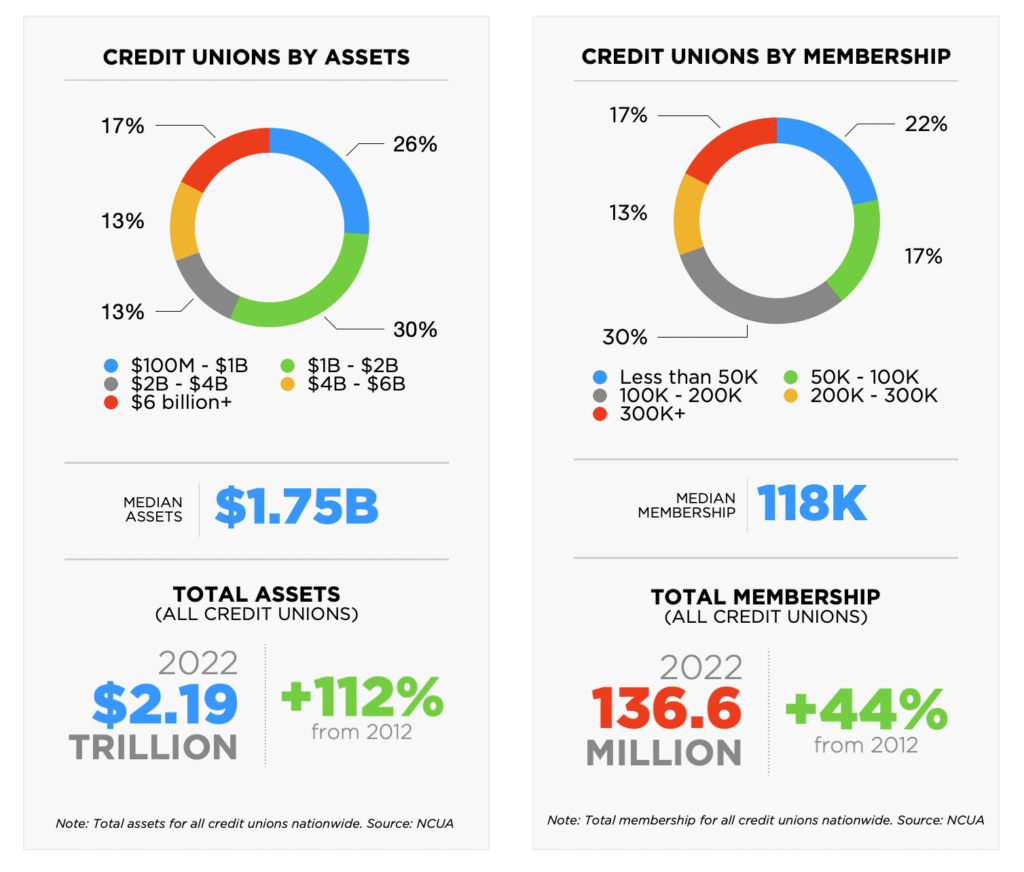

More than 135 million people are now members of credit unions in the United States, up 44% from a decade ago. More telling, however, is credit union assets have more than doubled during that same period to $2.19 trillion. Overall credit union marketing budgets have exceeded asset growth levels, but are still relatively low compared with major financial service companies. And yet credit unions are one of the fastest growing sponsorship and naming rights categories in the industry for sports teams and universities due to expanding partnership efforts.

Committing significant portions of marketing budgets to sponsorships is new for some organizations. All survey participants reported that sponsorships have been added to their marketing programs within the past 20 years. As budgets have increased, credit unions have sought non-traditional forms of media to reach out-of-home audiences while complementing existing social/digital marketing channels. As credit unions become larger and more comprehensive financial institutions, their mass appeal has opened new avenues for marketing and partnerships.

PARTICIPANTS

This survey was conducted from April to July, 2023. Twenty-three (23) credit unions provided in-depth responses about their sponsorships and naming rights partnerships, representing a diverse group of credit unions both geographically (across 15 states in all regions of the country) and economically. Many credit unions, including some in the survey, have been expanding fields of membership and altering charters to drive growth. Notably, six of the credit unions surveyed made a change to their fields of membership within the past year.

KEY FINDINGS

The results of the inaugural study uncovered a demand for sponsorships and naming rights by credit unions. Participants look for metrics and qualitative/quantitative results to help them maximize their significant investments in sponsorship and naming rights as a percentage of their media/marketing mix. Measurement is a challenge to credit unions who typically look at traditional media channels like digital, social, OOH, radio and TV/broadcast for data.

MARKETING

Overall, typical budgets ranged up to $20 million annually. Traditional paid media accounts for less than 50% of marketing expenditures for the vast majority of those surveyed. The majority of credit unions allocate 26-50% of marketing budgets to sponsorships and an even higher percentage consider sponsorships to be a “very” important part of the overall marketing mix. This is because sponsorships offer a mix of traditional paid media advertising along with affinity marketing.

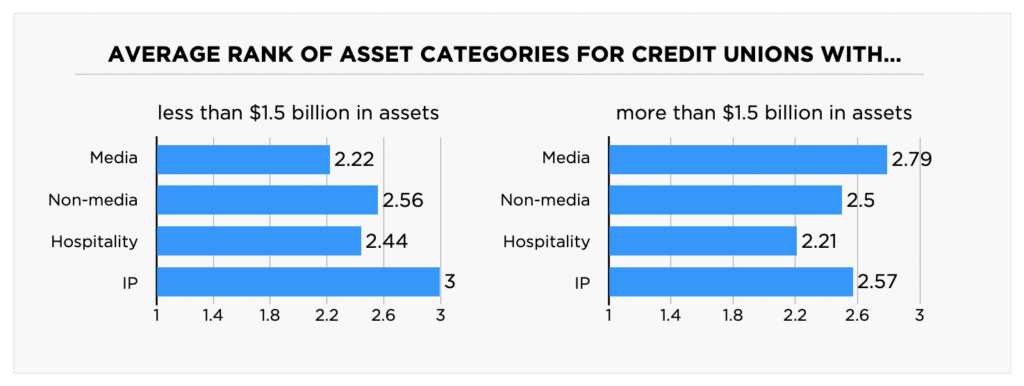

When asked about views on sponsorship asset categories, media assets were ranked highest among respondents with assets greater than $1.5 billion. Intellectual property was the most polarizing category. It was ranked highest and lowest by four credit unions each among the 14 credit unions with $1.5 billion in assets or more. That reflects the importance of tailoring partnerships to satisfy individual marketing objectives.

In contrast, small credit unions (those with less than $1.5 billion in assets) ranked intellectual property rights as the most important and media assets as least important.

Among individual asset categories, exclusivity ranked highest despite two credit unions giving it the lowest score possible. It was nearly universally recognized as the most effective element to drive return on sponsorship dollars. Other powerful assets were social media, promotions, on-site activations and public relations.

SPONSORSHIP

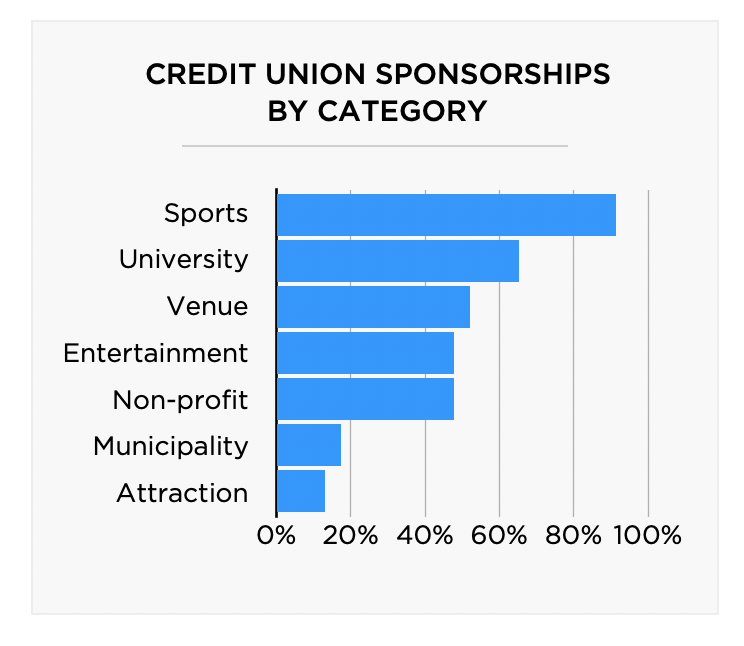

Sports is the dominant category among the types of credit union sponsorships, followed by universities, non-profits and venues. philanthropic efforts and community events.

For sports, collegiate teams are the most frequent partners for credit unions. While athletics represent one of the highest affinity groups with broad appeal, there were significant numbers of deals with student bodies and alumni associations. Alumni associations may be a potential group for credit unions to target within a university as these organizations can offer memberships that align with credit union demographics and offer penetration outside its hometown market.

MEMBERS & EMPLOYEES

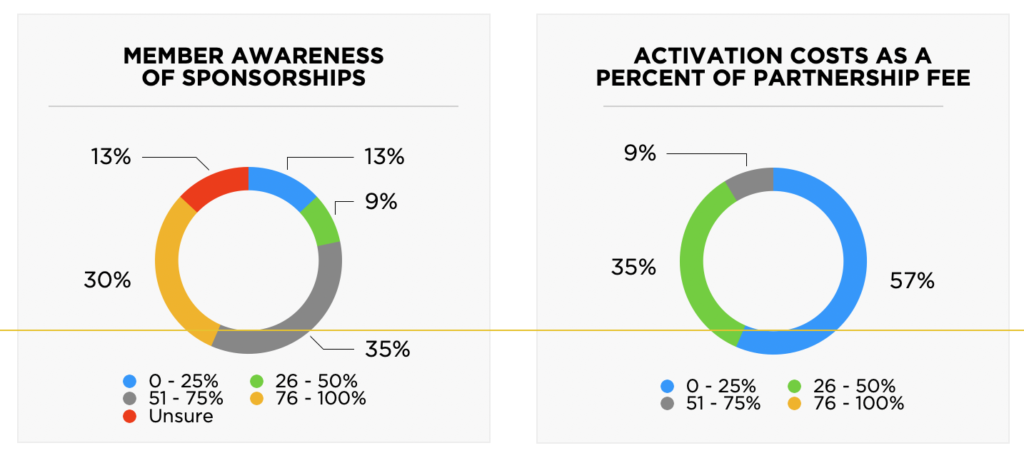

We asked credit unions to assess their members’ and employees’ awareness of their sponsorships. Credit union members need a high level of engagement with their institutions given their local community ties and niche membership groups. Large national banks and other financial institutions may have a more difficult time establishing an authentic connection with consumers.

The results show that credit unions have a lower awareness than what is deemed to be reasonably acceptable in sponsorship measurement. There is an opportunity to strengthen sponsorship activation and measurement programs to more adequately measure the unaided brand awareness of sponsorship which is one of the most critical elements of sponsorship.

Another key stakeholder group is the credit union employees. The majority of those surveyed indicated that employees are aware of partnerships, although the numbers decline slightly when asked if employees are positively impacted. Many of the sponsorship deals are focused and aligned with marketing goals and employee benefits are a secondary consideration. About half of those surveyed leverage partnerships through volunteerism, tickets, etc. This may be an underutilized area of partnership activation, which has been traditionally focused on brand awareness.

Activations are an additional cost for partnerships that must be considered to maximize value. Most credit unions dedicated 50% or less of a sponsorship fee to activation.

NAMING RIGHTS

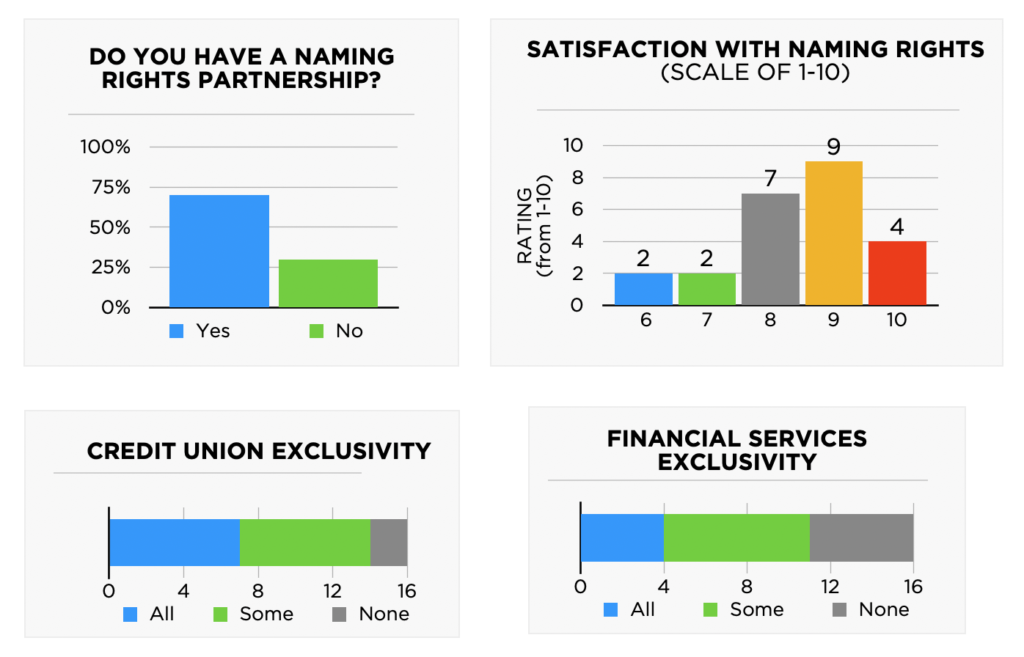

About two-thirds of those surveyed have at least one naming rights partnership. Credit union services are included in rights deals, but credit unions frequently offer more robust financial services. Exclusivity, which is usually a key component of deals for larger categories such as automotive and beverage, is important for credit unions - but only half of those who have naming rights partnerships include category exclusivity in the “credit unions” category for all deals while others include it in some of the time. The numbers decline for the broader banking category and financial services category designations.

BEST PRACTICES

Looking forward, credit union marketing executives are constantly looking for new ways to engage consumers. Media is a fragmented industry, but it’s possible to leverage different media channels combined with on-site activations and digital/mobile banking offerings to provide robust partnership opportunities. In addition, rights holders in emerging markets or with access to unique demographics that align with credit unions should seek ways to partner. Lastly, although the responsibility to measure a partnership could fall on both parties, credit unions desire better metrics that can be delivered more frequently to measure effectiveness.

To register for the 2024 Credit Union Sponsorship Survey, or to request a copy of the full Executive Summary, please email Jeff Dimond at jdimond@ipg360.com.

*Innovative Partnerships Group served as the third-party administrator of the survey and held participants’ data in the strictest confidence. The questions in this survey were reviewed by a Steering Committee made up of executives from a select group of credit unions in order to ensure accuracy, relevance, and ability to make an impact for those participating.