Innovative Partnerships Group’s team of consultants, data analysts, and marketing scientists have been on the cutting edge of partnership valuation for brands and monitors the trends in the sponsorship industry. We have performed dozens of naming rights and sponsorship valuations, and over the past 12-18 months we have had many clients, industry leaders and decision makers note there was a massive void in the market on data and trends related to hospitals/health systems and sponsorship.

This inaugural “Sponsorship and Naming Rights Study” is the first time that a company has taken an in-depth look at sponsorship, naming rights trends and best practices to help health systems maximize their sponsorship investments and understand critical best practices when negotiating and executing partnerships. The results provide benchmarking research and actionable insights to decision makers who support and influence future partnership marketing activities.

As health systems make investments to drive profitable growth strategies and provide more patients with access to quality care -- amidst higher costs and mergers -- healthcare organizations are still projected to spend more than $12 billion in 2024 on local advertising (according to a report). And despite a downturn because of Covid, health spending increased by 4.1% in 2022 and looks to continue to rise in the years ahead.

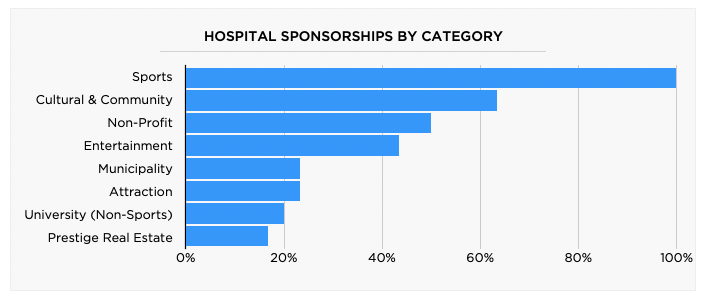

While sponsorships are not new to many health systems, committing substantial portions of marketing budgets may be more challenging in today’s climate. But with significant mergers comes the need to raise brand awareness, especially as hospitals and health systems move toward a regional approach. As our study demonstrates, while all 30 participants activate in sports, there are many categories inside and outside of professional/collegiate sports that are still ripe for partnership. Youth and amateur sports, school districts, mixed-use districts, zoos, film festivals, etc. are all underutilized properties and are typically available to health system partners as a viable way to reach – and increase – patient affinity for their brand.

PARTICIPANTS

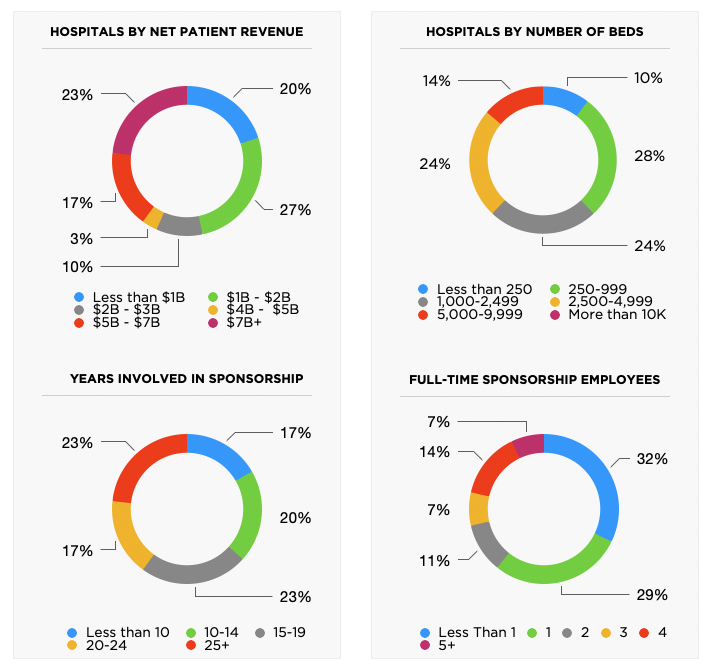

This study was conducted from Feb-April, 2024. Thirty hospitals and health systems provided in-depth responses about their sponsorships and naming rights partnerships. Participants represent a diverse group of hospitals both geographically and economically. Participating hospitals had net patient revenue ranging from under $1 billion to more than $10 billion (with a median asset size of $1.75 billion). Of those surveyed 90% had more than 1,000 beds. Most hospitals have vast experience in the sponsorship industry, with more than 80% indicating 10+ years of experience.

KEY FINDINGS

The results of the inaugural study uncovered meaningful results that had not been typically captured for this important industry. It is clear that the rise in naming rights and high value assets for hospitals and health systems is one of the fasting growing sponsorship categories in the United States. It is even more evident that participants are continuing to look for metrics and qualitative/quantitative results to help them maximize their significant investments in sponsorship and naming rights as a percentage of their media/marketing mix.

MARKETING

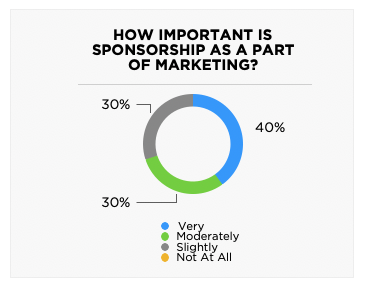

Overall, typical marketing budgets ranged up to $60-80 million annually. The majority of hospitals allocate 0-25% of marketing budgets to sponsorships, yet more than two-thirds consider sponsorships to be a “very” important part of the overall marketing mix. This indicates strong profitability from hospitals and health systems with the wherewithal to allocate a smaller percentage of marketing dollars toward sponsorship, while still spending a “healthy” amount.

The top 13 largest hospitals surveyed (those with more than $4B in annual net patient revenue) tend to spend less on sponsorships as part of its marketing mix. And less than 40% (5 of 13) indicated that sponsorship was a “very important” part of their marketing mix. This is probably more indicative of large hospital marketing budgets and allocations toward various expenditures versus overall attitudes toward sponsorship as a whole. However, there are still impactful deals that smaller hospitals and health systems could engage in, especially in smaller communities, to mirror expenditure budget models of their larger counterparts by partnering with smaller universities, municipalities, arts and music, etc.

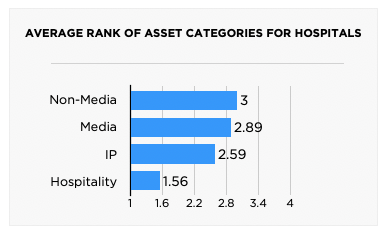

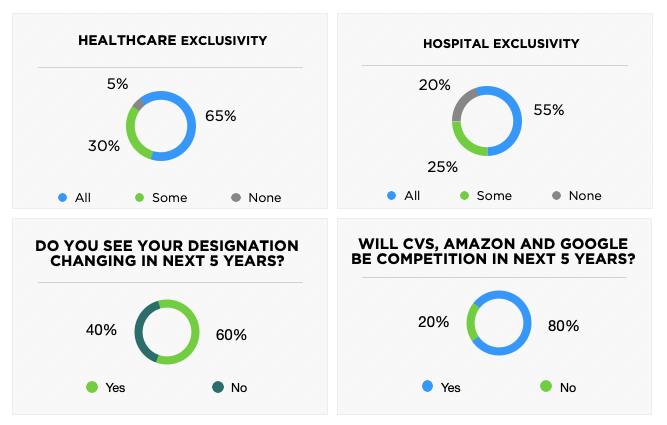

When asked about views on sponsorship asset categories, non-media and media assets were ranked highest among respondents. Hospitality consistently ranked last or next to last with all but a few hospitals. Intellectual property was a polarizing category, as about 1/3 ranked it last while 1/3 ranked it first. As one hospital executive stated, “the overall designation and relationship trumps everything.” The difference in opinions on asset categories reflects the importance of tailoring partnership deals to satisfy different marketing objectives among those in this industry.

Among individual asset categories, direct healthcare services ranked the highest while exclusivity ranked next. Media assets, especially social media, PR and TV-visible signage, were also considered to provide very effective value.

It is not surprising that most health systems do not put a high emphasis on business development, or hospitality and VIP experiences. It is surprising, however, to see the lack of importance given to employees. This would seem to be an area to increase programming given the turnover rates and retention difficulties in health care post-COVID.

SPONSORSHIP

The study asked about the types of sponsorships in which hospitals engage. Sports is the dominant category with 100% of participants surveyed having at least one partnership, followed by Cultural & Community, Non-Profit and Entertainment. At least one in six (1 in 6) participants had one or more sponsorships within Municipality, Attraction, University (Non-Sports) and Prestige Real Estate indicating a wide variety of property opportunities. Within each of these categories, we asked for a breakdown of category-specific subtypes. Festivals (non-music) was the most-popular non-sports rights holder.

Evaluation Methods & Tracking

Given that brand awareness was the top reason to engage in a sponsorship, it made sense that KPIs tracking brand awareness were the most important to those surveyed. Community give-back/involvement scored the next highest on average (3.73).

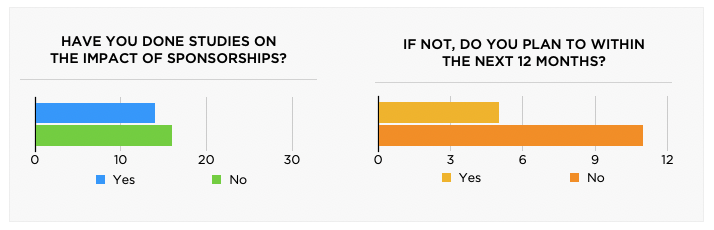

Evaluating sponsorship effectiveness can be difficult, especially when engaging in only a few deals with vastly different partners. Metrics can be difficult to quantify and even more challenging to measure, especially on an ongoing basis. About half of those surveyed have a formal process for evaluating sponsorships. Interestingly, of those hospitals who do not have a formal process, seven are engaged in naming rights or high value assets where the spends are typically higher and ROI may be even more valuable to track.

As marketing budgets expand and there is greater scrutiny of spending as related to marketing objectives, the evaluation approaches should increase.

Patients & Employees

Patient care is the backbone of any healthcare institution, especially when hospitals are not only competing for patients in their own backyards (markets), but are looking to attract from across their region, the nation and beyond. And with recent mergers, it is essential that trust is established with these new health system brands.

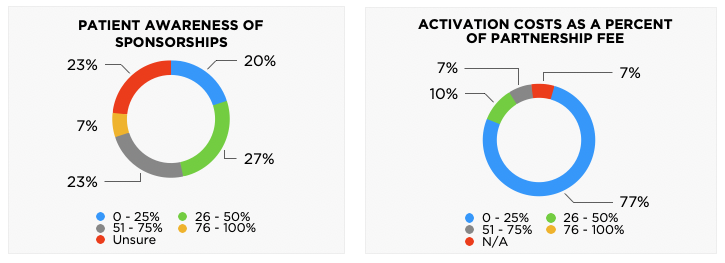

The results show that health systems have a lower awareness than what is deemed to be reasonably acceptable in sponsorship measurement. There is an opportunity to strengthen sponsorship activation and measurement programs to more adequately measure the unaided brand awareness of sponsorship, which is one of the most critical elements.

Another key stakeholder group is the health system employee.The majority of those surveyed indicated that employees are not aware of partnerships (less than 50%) or are unsure of the awareness levels. Many of the sponsorship deals are focused and aligned with marketing goals, while employee benefits are a secondary consideration. This may be an underutilized area of partnership activation.

Activations are an additional cost for partnerships that must be considered to maximize value. More than 75% of hospitals dedicate 25% or less of a sponsorship fee to activation.

NAMING RIGHTS

Two-thirds of those surveyed (20) have at least one naming rights partnership or entitlement to a high value asset, such as a training center, venue or jersey patch. Of those that do not have a naming rights partnership, only one (1) indicated that they are expected to pursue a naming rights opportunity within the next 12 months.

BEST PRACTICES

Looking forward, healthcare marketing executives are constantly looking for new ways to engage consumers, especially in the communities for which they serve. Media is a fragmented industry, but it’s possible to leverage different media channels combined with on-site activations and permanent signage opportunities to provide robust partnership branding. In addition, rights holders in emerging markets or with access to unique demographics that align with hospitals should seek ways to partner. Lastly, although the responsibility to measure a partnership could fall on both parties, hospitals desire better metrics that can be delivered more frequently to measure effectiveness.

To register for the 2025 Healthcare Sponsorship Study, or to request a copy of the full Executive Summary, please email Jeff Dimond at jdimond@ipg360.com.

*Innovative Partnerships Group served as the third-party administrator of the survey and held participants’ data in the strictest confidence. The questions in this survey were reviewed by a Steering Committee made up of executives from a select group of credit unions in order to ensure accuracy, relevance, and ability to make an impact for those participating.